Health Insurance in the Netherlands (2025 Guide)

“Discover essential guidance on Dutch health insurance for EU workers in 2025. Learn crucial steps to ensure compliance and secure the right coverage efficiently.”

✍️Health Insurance in the Netherlands (2025 Guide)

Essential info for EU workers living or working in the Netherlands

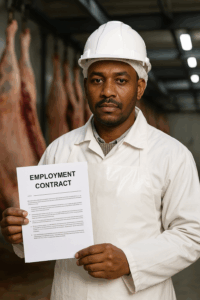

If you work in the Netherlands, you are legally required to have Dutch health insurance — even if you are from another EU country. Many people don’t know this, especially when arriving through an agency or staying temporarily. This guide explains what you must do, when to do it, and how to avoid problems.

🔹 Who needs Dutch health insurance?

If you work and pay tax in the Netherlands, then you must take out basic Dutch health insurance (zorgverzekering). This rule applies to:

- Workers from EU/EEA countries, including Romania, Poland, Portugal, Hungary

- People with a BSN number and a job in the Netherlands

- Anyone earning money that is taxed in the Netherlands

Even if you have a European Health Insurance Card (EHIC), it’s not enough when you start working here. The EHIC is only valid for short visits or emergencies — not regular employment.

🔹 When must you get insured?

You must take out Dutch health insurance within 4 months of starting work, but the coverage is retroactive to your first day of work. This means:

- If you wait 3 months and apply, you still have to pay from day 1

- If you don’t apply at all, you can be fined by the Dutch government

🕒 Don’t wait — it costs the same whether you register today or in 3 months, so register as soon as possible.

🔹 What does basic insurance cover?

The basic health insurance (basisverzekering) includes:

- General practitioner (GP or “huisarts”) visits

- Emergency care and hospitalization

- Medication (some)

- Maternity care

- Mental health support (limited)

- Specialist care by referral

It does not cover:

- Dental care for adults

- Physiotherapy (unless referred)

- Glasses, hearing aids, or extras

For these things, you can add supplementary insurance, but it’s optional.

🔹 How much does it cost?

As of 2025, the average price for basic insurance is:

- €138 – €155 per month, depending on the provider

- Higher “own risk” = lower monthly price, and vice versa

You also have an own risk (eigen risico) of €385 per year. This means you pay the first €385 of most treatments yourself (except GP visits, maternity, etc.).

📌 Good news: You may qualify for zorgtoeslag (healthcare allowance)

🔹 Can you get financial help?

Yes. If you earn below a certain amount, you can apply for zorgtoeslag — a monthly benefit from the Dutch government to help you pay for your health insurance.

In 2025, you may get:

- Up to €127 per month (single person)

- Paid directly into your bank account

To apply for zorgtoeslag, you need:

- A BSN number

- A Dutch bank account

- Dutch health insurance

You can apply through mijn.toeslagen.nl (Dutch only) or ask someone to help.

🔹 What if you don’t get insured?

If you fail to get insurance:

- The CAK (Dutch authority) will send you a warning

- You may be fined €472.25, and the fine may repeat

- Eventually, the government will force insurance on you — at a much higher cost

Your employer or agency is not responsible for your insurance. Even if they arrange housing or contracts — you must do this yourself.

🔹 How do you choose a health insurer?

There are many insurers (called “zorgverzekeraars”), and all offer the same basic package by law.

Popular providers include:

- Zilveren Kruis

- VGZ

- CZ

- Menzis

You can compare prices on:

Registration is usually possible online. You’ll need:

- BSN

- Dutch address

- Start date of employment

- IBAN bank account

❗ Make sure the insurance starts from the first day you started working.

🔹 Summary: What you need to do

| Step | Action |

|---|---|

| 1 | Check if you are working and earning income in NL |

| 2 | Choose a Dutch health insurer |

| 3 | Register online using your BSN and address |

| 4 | Pay monthly premiums |

| 5 | Apply for zorgtoeslag if your income is low |

🔹 Key Terms Explained

| Term | Meaning |

|---|---|

| Zorgverzekering | Health insurance |

| Eigen risico | Annual deductible you pay yourself |

| Zorgtoeslag | Government compensation for low-income earners |

| Zorgverzekeraar | Health insurance company |

| CAK | Government body that monitors insurance compliance |

💬 Still unsure what to do? We recommend asking someone to help you compare and apply. You can also contact your local gemeente or ask your employer for assistance — but you remain responsible for the registration.

Need us to help? Just ask at info@migrantinfocenter.com