How to Get a BSN Number in the Netherlands (2025 Guide)

Discover how to obtain a BSN number in the Netherlands, essential for employment, banking, and more. Streamline your transition smoothly.

If you plan to live or work in the Netherlands, getting a BSN number (burgerservicenummer) is one of the first things you’ll need to do. This personal citizen service number is required for almost everything — from starting a job to opening a bank account or getting health insurance.

This guide explains exactly what a BSN is, who needs it, how to get one, and what documents you need — written in simple language, especially for workers coming from other EU countries.

🔹 What is a BSN Number?

The BSN (burgerservicenummer) is your unique personal registration number in the Netherlands. Every resident or worker gets one, and it is used by the government, your employer, your bank, your doctor, and more.

You need a BSN to:

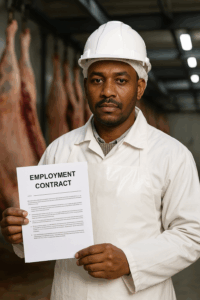

- Sign a work contract

- Receive a salary

- Register for health insurance

- Open a bank account

- Visit a doctor or hospital

- File your taxes

It’s basically your Dutch identity number — even if you are not Dutch.

🔹 Who Needs a BSN?

Everyone who:

- Works in the Netherlands

- Lives in the Netherlands longer than 4 months

- Pays taxes or receives government services

That includes people from:

- Romania

- Poland

- Portugal

- Hungary

- Any other EU/EEA country

Even if you stay only a few months, if you work legally, you still need a BSN.

🔹 Where and How to Get a BSN

There are two ways to get a BSN number:

✅ 1. If you plan to stay more than 4 months:

You must register with the municipality (gemeente) where you will live. This is called a registration in the BRP(Basisregistratie Personen = Personal Records Database).

What you need to do:

- Make an appointment with the gemeente where you live

- Go in person to register

- Bring the required documents (see below)

- You’ll receive your BSN number during or shortly after your appointment

👉 You must register within 5 days after arrival in your new city.

✅ 2. If you stay for less than 4 months (temporary work):

You must register as a non-resident in the RNI (Registratie Niet-Ingezetenen). You will still get a BSN.

There are only 19 municipalities that offer RNI registration. Examples include:

- Amsterdam

- Rotterdam

- The Hague

- Eindhoven

- Groningen

🔹 What Documents Do You Need?

To register and receive your BSN, you usually need:

For BRP (living in NL):

- A valid passport or EU ID card

- A rental contract or written permission from the person you’re staying with

- Proof of your address (like a housing registration or utility bill)

- Sometimes: your work contract

For RNI (short stay):

- A valid passport or ID

- The address where you are staying, even if temporary

- In some cities: proof of your job or reason for stay

📌 Tip: Always call or check the municipality’s website before your appointment. Some require extra documents or translations.

🔹 What If You Don’t Have a Fixed Address?

This is a common problem for many workers. If you don’t have a formal rental contract, here are your options:

- Ask your employer or agency to provide temporary registration for you

- Get a written statement from the person you’re staying with (plus a copy of their ID)

- Use an official RNI location, which does not require long-term housing

❗ Warning: Without a BSN, you cannot legally start work or receive a salary in most cases.

🔹 How Long Does It Take?

- At the municipality (BRP): You usually receive your BSN the same day or by post within a few days

- Via RNI: You receive it immediately during your appointment

Some cities have waiting times for appointments. Try to book one before you arrive if possible.

🔹 Can Your Employer Arrange It?

Sometimes, yes. Especially if you work through an agency. But:

- They can only help you make the appointment

- You must still go in person to register and receive the BSN

🔍 Be careful if an agency promises to “do everything for you” — always ask for your BSN number and check it yourself.

🔹 What’s the Difference Between BSN and RNI?

| BSN via BRP (full registration) | BSN via RNI (non-resident) |

|---|---|

| For stays > 4 months | For stays < 4 months |

| Registered as a Dutch resident | Registered as non-resident |

| Full access to all services | Limited access to housing, etc. |

| Must live at a fixed address | Can use temporary address |

If you continue working or staying longer, you will eventually need to switch from RNI to BRP by registering in a local gemeente.

🔹 Frequently Asked Questions (FAQ)

❓Can I start working before I get a BSN?

No. In most cases, your employer must report you to the tax authority, and this requires a BSN.

❓Can I use my BSN in another city?

Yes. Your BSN stays with you for life — even if you move cities or change jobs.

❓Is the BSN the same as a Dutch tax number?

Yes — your BSN is used by the Belastingdienst (tax office) for all income and tax matters.

🔹 Useful Links & Next Steps

✅ Summary: What You Need to Remember

| Step | Action |

|---|---|

| 1 | Choose: BRP (>4 months) or RNI (<4 months) |

| 2 | Make appointment at the gemeente |

| 3 | Bring passport, address proof, etc. |

| 4 | Register and receive your BSN |

| 5 | Keep your BSN safe — it’s your key to Dutch life |

Migrant Info Center Netherlands is here to help you take the first step. If you still have questions, contact us.