Dutch Payslip Explained: Understanding Your Salary and Deductions

Unlock the secrets of your Dutch payslip! Understand gross vs. net pay, deductions, and holiday bonuses to ensure you’re fairly paid and protected.

💶 Why your payslip matters

If you’re working in the Netherlands, you receive a payslip (loonstrook) every time you’re paid — weekly or monthly. Many EU workers ignore it, but it contains important details like:

- Your gross vs. net pay

- Hours worked and wage per hour

- Taxes and deductions

- Holiday pay and other bonuses

Understanding your payslip helps you spot mistakes, check your rights, and avoid being underpaid.

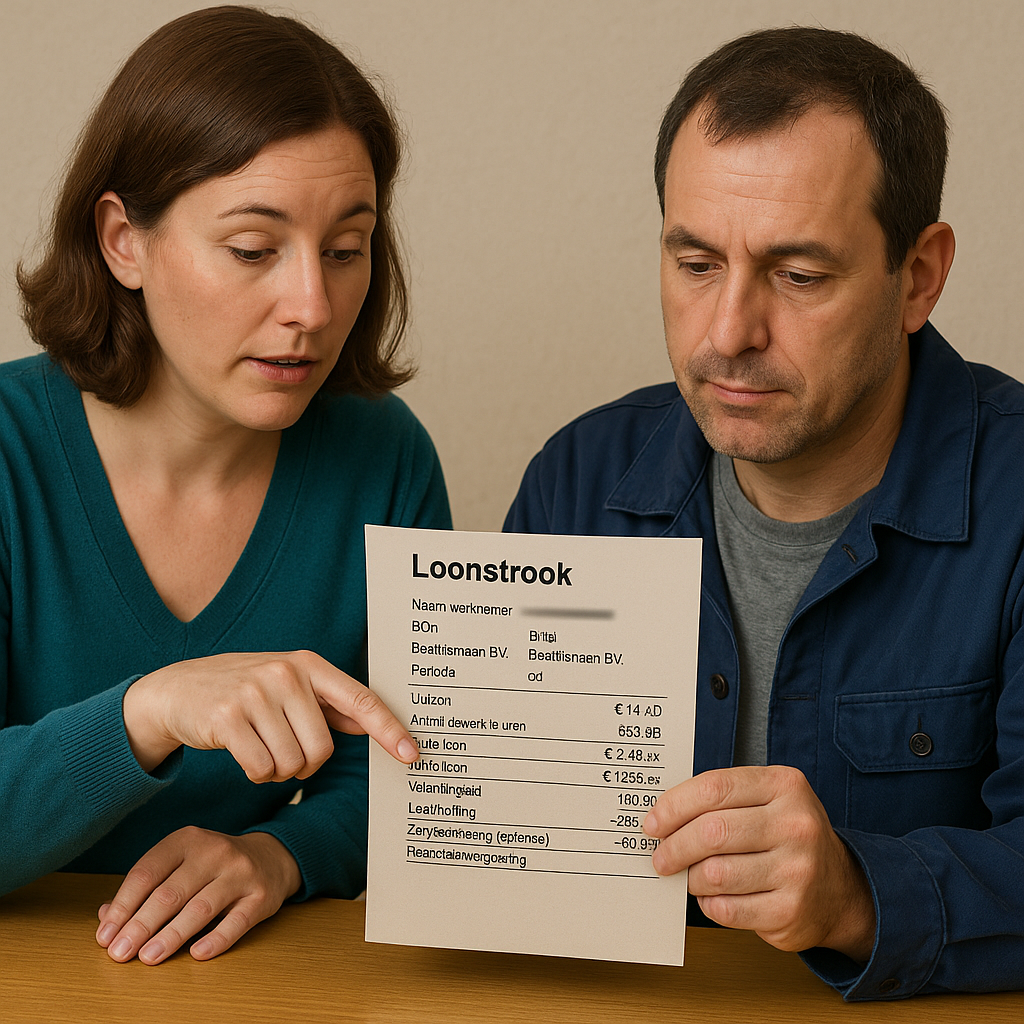

🧾 What’s on a typical Dutch payslip?

Here’s a breakdown of what you’ll usually see:

| Field | What it means |

|---|---|

| Naam werknemer | Your full name |

| BSN | Your citizen service number |

| Bedrijfsnaam | The company or agency employing you |

| Periode | The week or month the payslip covers |

| Uurloon | Your hourly wage (gross) |

| Aantal gewerkte uren | Number of hours worked |

| Bruto loon | Total before taxes and deductions |

| Netto loon | What you receive in your bank account |

| Vakantiegeld | Holiday pay (8% if not paid separately) |

| Loonheffing | Wage tax withheld |

| Zorgverzekering (optioneel) | Insurance deduction (if arranged via employer) |

| Reiskostenvergoeding | Travel reimbursement, if applicable |

| Toeslagen / bonussen | Extra pay (evening shift, weekend, etc.) |

📌 Each employer has their own format, but the required elements are always present.

💰 Gross vs. Net – What’s the difference?

- Gross (bruto): The full wage you’ve earned

- Net (netto): What you actually receive after taxes and deductions

Typical deductions:

- Wage tax (loonbelasting)

- Social contributions (AOW, WW, WIA)

- Possibly: zorgverzekering or housing if your employer arranges these

✅ You should always get a net pay that matches or exceeds the Dutch minimum wage after legal deductions.

🎁 Holiday Pay (Vakantiegeld)

You’re entitled to 8% of your gross wage as holiday pay. This may be:

- Paid monthly as part of your wage

- Saved and paid out in May or when your contract ends

Check if it’s listed as:

- “Vakantiegeld”

- “Opbouw vakantiegeld” (accumulated)

- “Incl. vakantiegeld” (already included)

🔢 What should you check each time?

- Is your hourly wage correct? (match contract and legal minimum)

- Is the number of hours correct?

- Is holiday pay visible or explained?

- Are any deductions unexpected or unclear?

🧠 If anything is unclear, ask your employer or check with a workers’ help desk. Never be afraid to speak up.

📉 Examples of suspicious deductions

- Housing: Only legal if you’ve signed an agreement and it’s clearly listed

- Health insurance: Allowed only if you’ve agreed and employer pays it on your behalf

- “Other” or “diverse” deductions: These should be explained in writing

If your payslip says:

- “Loon onder minimum”

- “Looncorrectie zonder uitleg”

- “Vooruitbetaling teruggehaald”

📢 It may indicate a problem or manipulation. Ask for clarification or support.

✅ Summary

| Section | Key points |

|---|---|

| 📄 Payslip info | Gross/net wage, hours, tax, extras |

| 💶 Gross vs. Net | Know the difference, track deductions |

| 🌴 Holiday pay | 8% must be paid monthly or yearly |

| 🚩 Red flags | Strange deductions, missing hours, unclear items |

| 🛠️ Take action | Ask, check, request explanation or legal help |